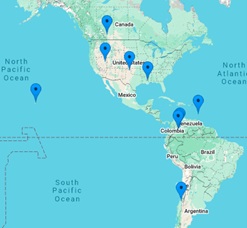

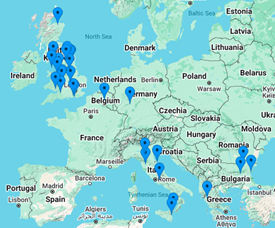

The above maps show the locations of selected businesses and projects in or being considered for the GGAF securities portfolios.

Jexium Ltd. is also the originator of underlying financing transactions for Global Green Asset Finance (GGAF), a Luxembourg-based securitisation platform which issues OTC and exchange-listed notes and bonds to finance cleantech and renewable energy businesses worldwide.

Qualified Professional Investors can share in commercial returns from GGAF’s global portfolios of green financing transactions, making positive climate and environmental impacts, while receiving competitive returns, regular income, and helping to fill the “green financing gap” in the market. We call our investment strategy IMPACT + INCOME℠ and we are ideally placed to deliver it.

GGAF products can be custom-tailored for private credit lenders, family offices, asset managers, private banks, and similar investors, as commingled portfolios, SIVs and/or directs, and we are pleased to develop custom portfolios and bundles of transactions. We currently offer:

- 5-year GGAF Notes (min. inv. €125k), backed by short-term senior secured loans for green project development pre-RTB. Target gross yield: 15%+.

- 10-year GGAF Notes (min. inv. €125k), backed by medium-term senior secured loans for plant and equipment assets. Target gross yield: 10%+.

- 15-year Bonds (min. inv. €125k) backed by longer term senior secured loans for post-RTB construction & post-COD operations. Target gross yield: 12%+

For larger institutional investors:

- Dedicated single investor vehicles (SIVs) to wrap custom portfolios of selected larger transactions according to investor preferences (min. inv. €50m).

- Direct funding, club and co-financing opportunities for selected larger transactions.

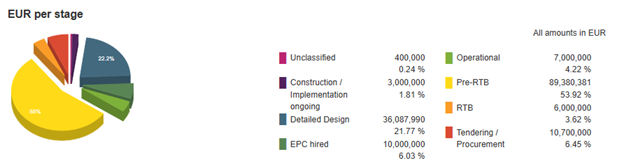

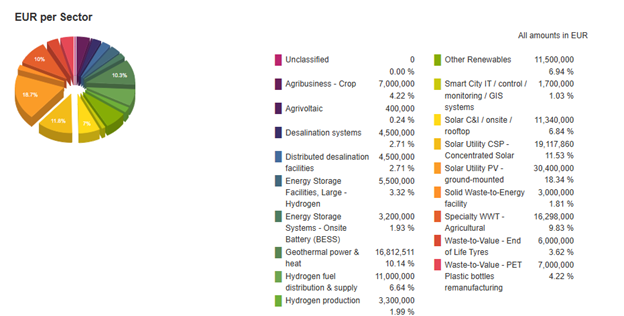

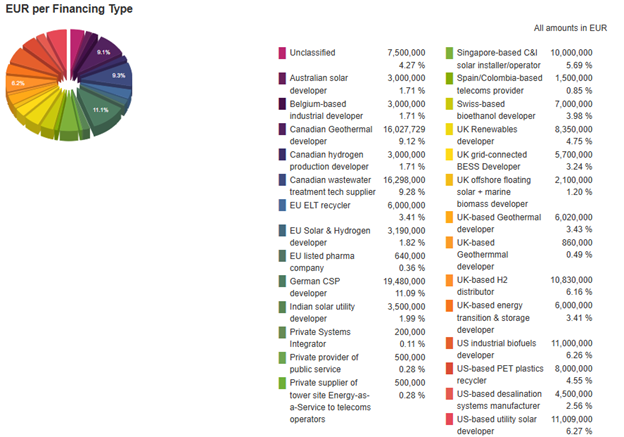

The charts below illustrate the Jexium inventory available for allocation to GGAF issues as of 2Q 2025:

For information on GGAF securities please contact ggaf@jexium.com and we will be in touch with you by email shortly.

GGAF SECURITIES ARE AVAILABLE ONLY BY PRIVATE PLACEMENT TO AND THROUGH REGULATED SECURITIES & INVESTMENT FIRMS SUCH AS BANKS, ASSET MANAGERS, INVESTMENT ADVISORS AND BROKER-DEAKERS. GGAF SECURITIES ARE AVAILABLE WIDELY, BUT NOT IN EVERY JURISDICTION, AND ARE SUBJECT TO VARIOUS OFFERING AND SUBSCRIPTION RESTRICTIONS. INTERESTED PARTIES SHOULD REQUEST AND READ THE PRIVATE PLACEMENT MEMORANDA FOR THE ISSUES.

NB: Target returns are goals only, and there is no assurance that the actual returns will meet these targets. Actual returns will depend on performance of the underlying financing transactions. The contents of this page and the map opportunity popups are for information purposes only and do not constitute an offer to sell or a solicitation to purchase any securities or investment product in any jurisdiction. The information presented here does not constitute investment advice or a recommendation and is not an invitation to invest. Nothing in this document is intended to nor will create any binding obligation on anyone. Applications should only be made based on the Private Placement Memorandum which are available from authorised distributors. Prospective investors should be capable of evaluating the risks and merits associated with this investment and have sufficient resources to bear any losses. These investments are intended to be held by the investor until maturity. Whilst a secondary market may exist, there is no guarantee of a purchaser. Liquidity may therefore be limited and should not be relied on when choosing this investment. Investment in the securities involves risk to your capital. If you suffer a loss, you are not entitled to compensation from the Financial Services Compensation Scheme. The issuer, CSM Securities Sarl is not regulated or authorised by the CSSF Luxembourg. Investing in the GGAF securities involves risks, including loss of capital and illiquidity and it should be done only as part of a diversified portfolio. This does not constitute an offer or solicitation with respect to the purchase or sale, investment, or subscription in any security and neither this fact sheet nor anything contained therein or the information to which it refers shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. In order to invest in the securities, you must confirm yourself to be a person (i) who has professional experience in matters relating to investments and fall within Article 19(5) of the Luxembourg Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the FPO) and/ or (ii) who are persons falling within Article 49(2)(a) to (d) of the FPO (iii) If contrary to the above you are not a relevant person but you are in receipt of this Investment Memorandum, then you must seek suitable financial advice before investing, to ascertain and understand the full risks and terms associated with any investment. Any investment in the securities is only available to, and will be engaged in with, relevant persons. You are strongly recommended to seek independent financial and legal advice before making an investment decision.